Q4 is always the busiest period of the year for ecommerce businesses. The holiday season sparks a wave of shopping habits and trends - if you play your cards right and adapt to these trends, it could mean a wealth of profits come your way.

The key is recognizing how consumers spend their money during this period and what influences their decisions. We’ve ground the numbers and found some key holiday spending statistics all ecommerce businesses need to know.

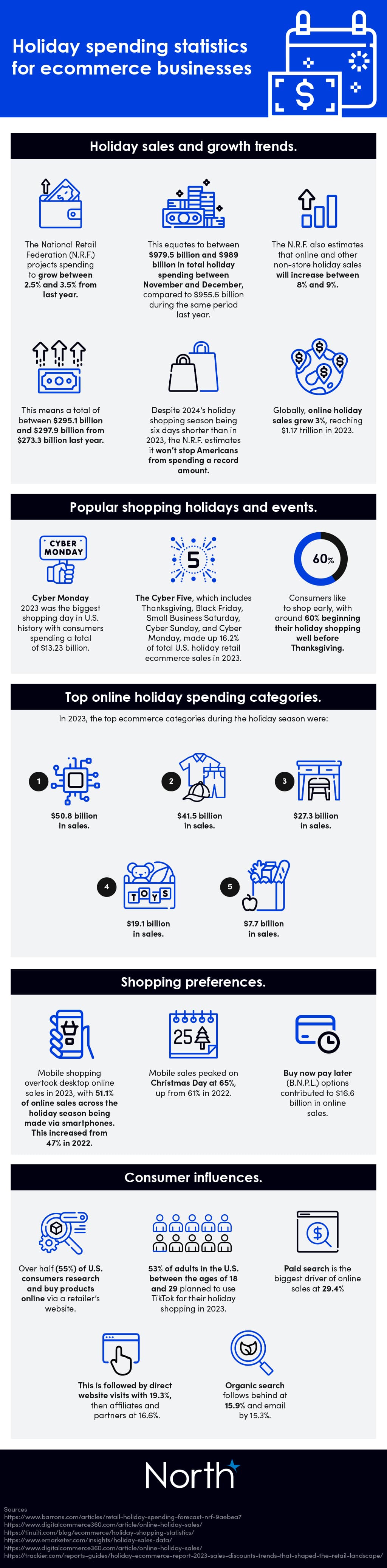

Holiday sales and growth trends.

Good news for ecommerce businesses across the country: the National Retail Federation (N.R.F.) estimates holiday spending will grow between 2.5% and 3.5% from 2023. For context, that’s anywhere between $979.5 billion and $989 billion in total across the whole of November and December. Last year, spending was around the $955.6 billion mark!

This is already a promising sign that indicates a rise in consumer spending, but it gets even better. The N.R.F. forecasts that online and other non-store holiday sales will see a boost of 8-9% when compared with the previous year. Moneywise, this is a total of between $295.1 billion and $297.9 billion - in comparison to $273.3 billion in 2023.

All of this news comes despite the holiday season being six days shorter in 2024. It appears that a reduction in shopping days will not stop the public from spending a record amount during the festivities. This follows a global trend that saw online holiday sales grow by 3%, reaching $1.17 trillion in 2023. All the data suggests this figure will be even bigger in 2024.

Popular shopping holidays and events.

Understanding when consumers like to shop during the holiday season will help you figure out the prime ways to target them with deals. A report from EMarketer looked at some key trends revolving around the most popular shopping holidays and events, discovering that Cyber Monday 2023 was the biggest shopping day in U.S. history. Consumers spent a whopping $13.23 billion on this day alone.

Likewise, The Cyber Five (Thanksgiving, Black Friday, Small Business Saturday, Cyber Sunday, and Cyber Monday) made up 16.2% of the total U.S. holiday ecommerce sales last year. In other words, if you’re not preparing your business to take advantage of these dates, you’re missing out on a lot of sales!

Tinuiti found another key trend that showed a preference for shopping early during the holiday season. 60% of shoppers will start looking for gifts and shopping well before Thanksgiving, meaning you have to prepare as early as possible.

Top online holiday spending categories.

What products are consumers most likely to spend their money on during the holiday season? Research from Digital Commerce 360 shows the top five categories as:

- Electronics - In 2023, electronics accounted for $50.8 billion in sales during the holiday shopping period, the highest of all sales figures.

- Apparel - Next in line is apparel, which generated an impressive $41.5 billion in sales.

- Furniture - Third place goes to furniture, which amassed $27.3 billion in holiday sales.

- Groceries - A surprising entry in fourth (largely influenced by Thanksgiving and Christmas), groceries saw $19.1 billion in sales during the 2023 holiday season.

- Toys - Rounding out the top five is toys, which only saw $7.7 billion in sales.

This shows you where people love spending their money and what types of products are better to market than others. We should also note that electronics came in first for the highest average discounts during the holiday season in 2023.

It averaged a 31% discount on products, which could indicate why it’s so far ahead in the top spot and highlights the importance of good discounts for your customers.

Shopping preferences.

You’ve seen when consumers are likely to shop and what they’re most likely to spend their money on - but how do consumers shop during this busy retail period? A deeper look into shopping preferences shows some significant facts and figures.

For one, mobile shopping officially overtook desktop sales for the first time in 2023. 51.1% of all online sales during the holiday period were made via smartphones.

This was a 3.1% jump from the 47% mobile sales figures in 2022 - and forecasts indicate it could increase further in 2024. Another interesting tidbit: mobile sales peaked on Christmas Day at 65%, up from 61% the year before. Experts suggest this is one of the best days to target mobile sales as consumers want to snag a few last-moment deals in the holiday season but don’t want to spend all of Christmas Day sitting at their computers.

The growth in mobile payments means it’s now more important than ever to accept an array of payment methods. Working with a merchant provider like North will help you do this. We provide a range of payment systems to set up on your website or mobile site so you can capitalize on the increased holiday sales by ensuring everyone has an easy way to pay.

One final shopping preference trend is the way people pay for things. Buy Now Pay Later (B.N.P.L.) became a widely popular payment option in 2023, contributing to $16.6 billion in online sales. Setting up a system like this on your website could help you tap into more consumer preferences.

Consumer influences.

Lastly, let’s look at what influences consumer decisions during this busy shopping period. The EMarketer report we mentioned earlier also shows that 55% of adults will research and buy products through a retailer’s website.

This emphasizes improving your product listings and landing pages to boost conversions. People rely on your site for information, so you must provide it!

The same report also indicates that 53% of U.S. adults in the 18 to 29 age range will use TikTok for holiday shopping in 2024. Comparatively, only 36% of the total population will use this platform. It’s a key statistic when you consider your target demographic: you must leverage TikTok marketing if your target consumers fall within that age bracket.

Speaking of marketing strategies and tactics, we found information from Trackier that broke down the top five marketing channels for holiday shopping:

- Paid Search - The biggest driver of online sales at 29.4%.

- Direct Website Visits - 19.3% of sales came through this method.

- Affiliates & Partner Marketing - This accounts for 16.6% of all online sales.

- Organic Search - Working on SEO helped companies amass 15.9% of holiday sales.

- Email Marketing - Made up 15.3% of sales.

Aside from Paid Search, most of these avenues have similar percentages, meaning they’re equally effective. However, it does indicate that perhaps most of your budget should go towards targeting paid search ads to generate the most sales during the holiday period.

These are the biggest holiday spending trends and statistics to pay attention to in 2024. Go back through them all and use the data to fuel your decisions during the holiday period.

It’ll help you take full advantage of the biggest spending period of the year, ensuring you maximize ecommerce profits!

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.